When a doctor writes a prescription for a brand-name drug, most states let pharmacists swap it for a cheaper generic version-unless the doctor says no. This system, called generic substitution, was designed to save patients and insurers billions. But over the last 20 years, big drug companies have found ways to break it. They don’t just wait for patents to expire. They actively destroy the market for the original drug before generics can even step in. This isn’t innovation. It’s a legal loophole exploited to keep prices high.

How Product Hopping Kills Generic Competition

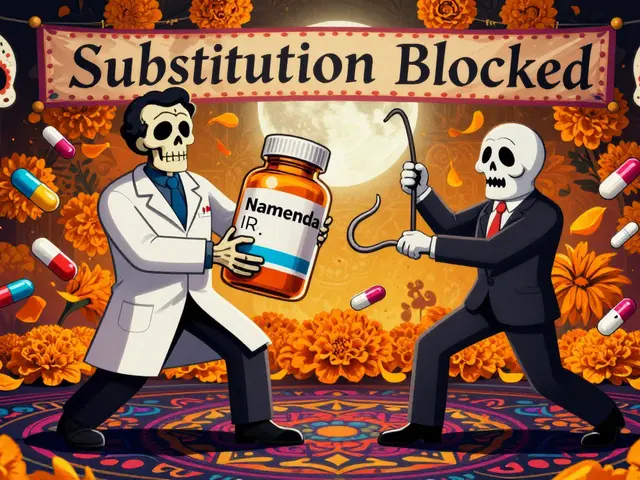

The most common tactic is called product hopping. A company releases a slightly changed version of a drug-maybe a new pill shape, an extended-release formula, or a different delivery method-then pulls the original version off the market. The new version isn’t better. It doesn’t work faster, safer, or more effectively. It just has a new patent. And because state substitution laws only allow pharmacists to swap drugs that are identical in active ingredient and strength, the new version blocks generics from stepping in. Take Namenda, a drug for Alzheimer’s. In 2013, Actavis introduced Namenda XR, an extended-release version. Thirty days before the original Namenda IR’s patent expired, they stopped selling it. Pharmacists couldn’t substitute generics for Namenda IR anymore because it no longer existed. Patients were forced to switch to Namenda XR, which was still under patent protection. The Second Circuit Court of Appeals ruled in 2016 that this was illegal. Why? Because generics had no chance to compete. The court called it a “manufactured barrier” to competition.Why Patients Can’t Just Switch Back

You might think: “If the original drug is gone, why don’t patients just go back to the generic?” Because it’s not that simple. Once a patient is switched to a new formulation, doctors rarely re-prescribe the old one. Pharmacists can’t refill an old drug that’s been pulled. Insurance systems don’t always track substitutions well. And patients, especially older ones with chronic conditions, don’t want to keep changing pills. The transaction cost-time, confusion, potential side effects-is too high. In the Suboxone case, Reckitt Benckiser replaced the original tablet form with a film strip. They didn’t just launch the film-they ran ads claiming the tablet was unsafe, even though there was no evidence. The FTC found this was a deliberate effort to scare patients and doctors away from the tablet, which was the only version generics could legally substitute. The result? Suboxone film sales jumped, while generic tablets never gained traction. The FTC settled for $1.4 billion in 2019 and 2020.REMS Abuse: Blocking Access to Samples

Another tactic is abusing the FDA’s Risk Evaluation and Mitigation Strategies (REMS) program. REMS are meant to manage serious drug risks-like preventing birth defects with Accutane. But some companies use them to block generic makers from getting the samples they need to prove their drug is bioequivalent. Without samples, generics can’t run the tests required for FDA approval. In 2017, legal scholar Michael A. Carrier found over 100 generic manufacturers had been denied access to samples for more than 40 drugs. One study estimated this alone was costing the system over $5 billion a year. These aren’t safety concerns. They’re legal shields. The FDA has no power to force companies to hand over samples. That’s why the FTC and DOJ now treat REMS abuse as a potential antitrust violation.

Why Some Courts Say It’s Legal

Not every court sees it the same way. In 2009, a case against AstraZeneca over switching from Prilosec to Nexium was thrown out. Why? Because Prilosec was still on the market. The court said adding a new product was just competition, not monopoly behavior. That’s the key difference: if the original drug stays available, courts often say it’s fine. But if it’s pulled? That’s where things get illegal. This inconsistency creates a patchwork of rules. In New York, courts blocked product hopping. In other states, companies got away with it. The FTC’s 2022 report called this a “major gap” in antitrust enforcement. They argued courts are ignoring the real-world impact of state substitution laws-laws that were meant to be the engine of generic competition.What’s at Stake: Billions in Extra Costs

The financial toll is staggering. Revlimid, a cancer drug, went from $6,000 a month to $24,000 over 20 years. Humira and Keytruda each cost over $10,000 per dose. In Europe, generics entered quickly. In the U.S., they didn’t. The result? An estimated $167 billion wasted on just three drugs because of delayed generic entry. When generics enter without interference, they capture 80-90% of the market within months. But when product hopping works? That number drops to 10-20%. In the Ovcon birth control case, a manufacturer introduced a chewable version and pulled the original. Generic sales never recovered. Patients paid more. Insurers paid more. Taxpayers paid more.

Enforcement Is Starting to Catch Up

The FTC has been pushing back. After the Namenda ruling, they got a court order forcing Actavis to keep selling the old version for 30 days after generic entry. In the Suboxone case, they forced Reckitt to pay billions and change its marketing practices. The DOJ has also gone after generic manufacturers-for price-fixing. Teva paid a $225 million criminal fine in 2023, the largest ever for a domestic antitrust case. State attorneys general are stepping in too. New York sued Actavis in 2014 and won an injunction. Other states are watching. The FTC is now lobbying state legislatures to strengthen substitution laws, making it harder for companies to exploit loopholes.What’s Next: More Lawsuits, Maybe New Laws

The legal battle isn’t over. Courts are still split. The FTC’s 2022 report was a wake-up call. In 2023, the DOJ and FTC held joint hearings on generic competition. Congress is paying attention. Lawmakers are considering bills that would:- Force drugmakers to provide samples to generics under penalty

- Define product hopping as an antitrust violation

- Require companies to notify regulators before pulling a drug from the market

What You Can Do

If you’re on a brand-name drug that’s about to lose its patent, ask your pharmacist: “Is there a generic version available?” If your doctor prescribes a new version right before generics launch, ask why. Is it better? Or just newer? Don’t assume the change is medical. It might be financial. Stay informed. Support policies that protect generic substitution. The system works when it’s not rigged.What is product hopping in the pharmaceutical industry?

Product hopping is when a drug company releases a slightly modified version of a brand-name medication-like a new pill form or extended-release formula-and then stops selling the original version right before generics can enter the market. This blocks pharmacists from substituting cheaper generics because the original drug no longer exists. The new version has a new patent, keeping prices high.

Why can’t pharmacists just substitute generics if the original drug is pulled?

State laws only allow substitution when the original drug is still available and identical in active ingredient. Once the brand removes the original version, the pharmacy can no longer legally swap it for a generic. Patients are forced onto the new, still-patented version, even if it’s not better. Switching back later is rare because doctors rarely re-prescribe the old drug, and patients don’t want to change again.

How does REMS abuse block generic drug entry?

REMS programs are supposed to manage serious drug risks, like birth defects. But some brand-name companies use them to deny generic manufacturers access to the samples they need to prove their drug is bioequivalent. Without samples, generics can’t get FDA approval. More than 100 generic companies have reported being blocked this way, costing the system over $5 billion a year in delayed competition.

Has the FTC taken action against product hopping?

Yes. In the Namenda case, the FTC won a court order forcing Actavis to keep selling the original drug for 30 days after generics entered. In the Suboxone case, the FTC forced Reckitt Benckiser to pay $1.4 billion and stop misleading marketing after it pushed patients from tablets to films using false safety claims. These are landmark cases that set legal precedents.

Why do some courts allow product hopping while others don’t?

It depends on whether the original drug stays on the market. Courts have ruled that if the original version is still available (like Prilosec after Nexium launched), adding a new product is seen as competition. But if the original is pulled (like Namenda IR), courts see it as an attempt to block generics. The key difference is eliminating consumer choice versus expanding it.

How much money do these tactics cost consumers?

The FTC estimates delayed generic entry due to product hopping and patent thickets costs U.S. consumers and taxpayers billions annually. Just three drugs-Humira, Keytruda, and Revlimid-have cost an estimated $167 billion more in the U.S. than in Europe, where generics enter faster. Revlimid’s price jumped over 300% in 20 years, largely because generics were blocked.